GMR 66: What's New About FICO Scores

Episode 66

Having a healthy FICO score is important to your financial well-being. Therefore, it’s important to understand how your FICO score is calculated and also to stay up to date on any changes that occur. On this episode we discuss some recent changes to the FICO score and why these changes are good for your score.

SHOW NOTES

FICO Score Basic

Credit Score ranges between 300-850

Credit score rankings:

300-620 - Bad

620-660 - Fair

660-720 - Good

720-850 - Excellent

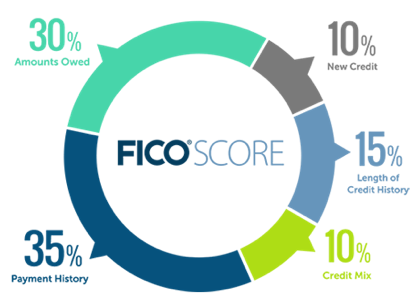

How credit score is weighted:

35% - Payment History

30% - Amount Owed

15% - Length of Credit History

10% - New Credit

10% - Credit Mix - Types of credit

FICO Score Change Updates

Medical debt not part of the equation anymore.

Other items such as, library fines and traffic tickets will no longer be on your report.

Tax liens and civil judgements have been removed from reports and will no longer impact your score.

Old consumer debt that’s paid off remains on your record but will not count against your score.

Creditworthiness of people who haven’t borrowed in the past (no extensive credit use record) will be more favorable.

Consumer debt that’s not paid in full will negatively impact your score. The more you pay off the balance the better your score.

Remember you can also freeze your credit report for free now. Learn more from episode 53 “Credit Freeze - A Great Way to Keep Your Identity Safe”

Resources

Credit Freeze: A New Way to Keep Your Identity Safe (Podcast)

Budgeting and Debt Elimination Tools

Jesus on Money by David Thompson - stewardshippastors.com